HANDLING OF THE CO2 LEVY

Home » CO2 TAX WHEN IMPORTING A CAR INTO SWITZERLAND – EVERYTHING YOU NEED TO KNOW » HANDLING OF THE CO2 LEVY

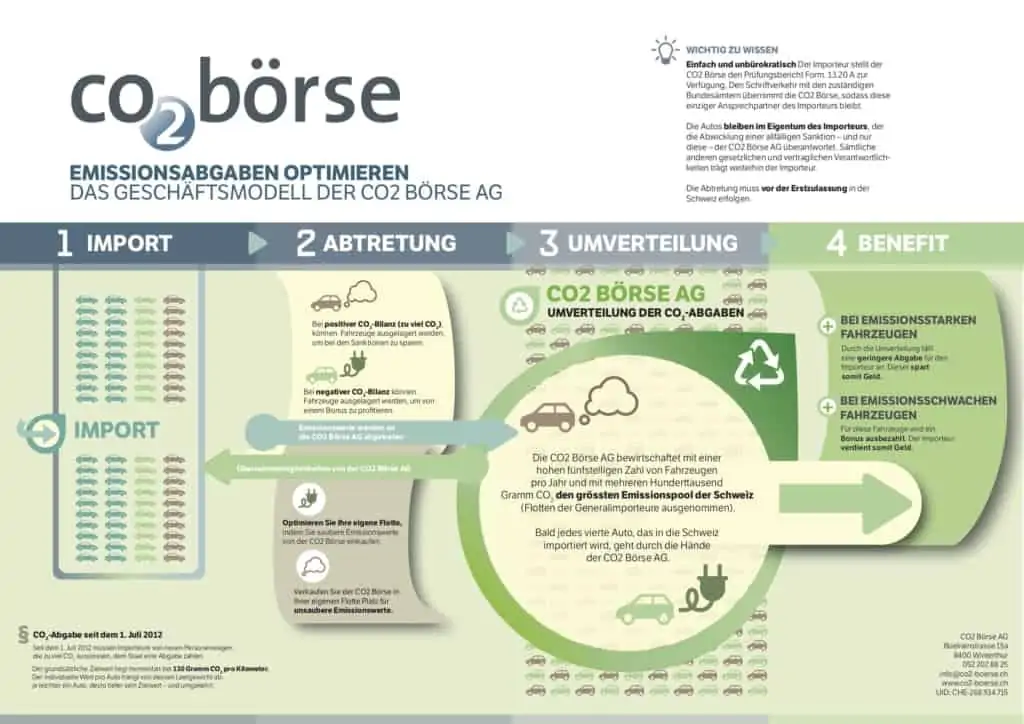

If the CO2 tax is processed via CO2 Börse AG, various solutions are available. Find out which process is most efficient for you.

More about the CO2 levy

Stay up to date

Stay up to date

PROCESSING WITHOUT TYPE CERTIFICATE

SMALL IMPORTERS AND LARGE IMPORTERS

Companies from the car trade (small importers and large importers) can register free of charge on the CO2 Börse AG dealer platform. The vehicle is electronically registered on the platform and automatically generates a CO2 cession form. The form is delivered as an e-mail within a few seconds. The following records must then be sent to FEDRO:- Form 13.20 A (Swiss customs)

- COC (Certificate of Conformity)

- CO2 Assignment Form

- Foreign registration certificate, if applicable

Individuals

Private individualscan calculate the CO2 taxand then send the original documents for CO2 processing to the headquarters of CO2 Börse AG in Winterthur:

- 13.20 A (customs document)

- COC (Certificate of Conformity)

- Foreign registration certificate, if applicable

CO2 Börse AG then checks the documents and sends the dossier including the CO2 transfer form to FEDRO in Bern. After successful receipt of payment, the original documents will be returned to you. Processing usually takes 3 and 5 working days.

PROCESSING WITH A TYPE CERTIFICATE

If a vehicle is inspected via a self-inspection and thus receives a type certificate number, the CO2 tax can be processed on the same day. The vehicle is recorded electronically on the CO2 Börse AG dealer platform and is automatically registered with the Federal Roads Office for CO2 cession.

The following documents are required for the electronic assignment:

- Form 13.20 A

- Type certificate

After processing, you will receive a confirmation by email. No further steps need to be taken.

If you have any further questions regarding the handling of the CO2 tax, just let us know. We are happy to support you in the individual process steps.